The financial sector is at the heart of tackling climate change and carrying out the climate change stress test is important. There are losses linked with having stakes in polluting firms and risk losses from extreme weathers.

Climate Risk can be mainly due to two channels (Battiston ea. 2017):

1. Physical Risk: Physical risks are the risks associated with the physical effects of climate change. Risk due to extreme conditions in the environment such as extreme weather/ Temperature increases/ polar cap melting/epidemics, recent example bushfire in Australia can lead to capital losses and loss of assets.

2. Transition Risk: Transition risks are the risks associated with the transition to a low-carbon economy. Risk due to disordered policy which may lead to financial instability and volatile stock prices/assets (Carney 2015; ESRB 2016, Monasterolo ea 2017).

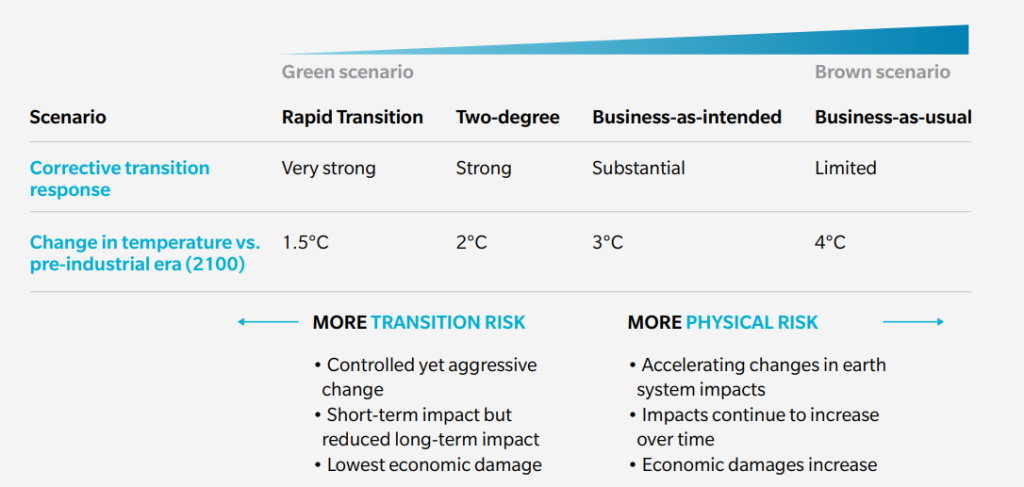

Climate scenarios and high-level implications:

Source: Oliver Wyman

Why Climate stress test is important? Exactly for these reasons, our investments in equities and stocks leads to volatility due to climate risk and thus, instability in investor’s financial position.

The bank needs to include sources of risk in the financial risk assessment and stress testing of their assets apart from their regular parallel and non-parallel shocks on their balance sheet.

In todays, world economy where all the financial institutions are inter-connected with economic activity around the world risk propagates upwards starting from investor’s capital to as big as exposure to financial institutions.

Climate Risk Management

In this context, our policies should be forward looking with the focus on climate risk as this will create market instability, if not done right. Similarly, our financial models should include climate- enhanced financial valuation of assets (Battiston & Monasterolo 2019).

Financial Institutions (FI) are interconnected with all kinds of economic activity in the system, they are connected with Firms to provide them with financial assistance, and their stakes in such firms. They also have exposures to such households which directly or indirectly depends on the industrial sectors which have high carbon footprints.

Then the further impact is when investors invest in such exposures particularly FI because if there are high volatility due to investments in such firms then there is a risk of having negative impact on investor’s funds such Insurance and pension funds.

By seeing this example, we now know how much important FI plays a role in tackline the climate related risk. These risks are under the category of unknown meaning no capital allocation or no inclusion in financial models are been done to tackle such risks.

Now is the time when FIs should treat climate risk as a financial risk, not just as a reputational one.

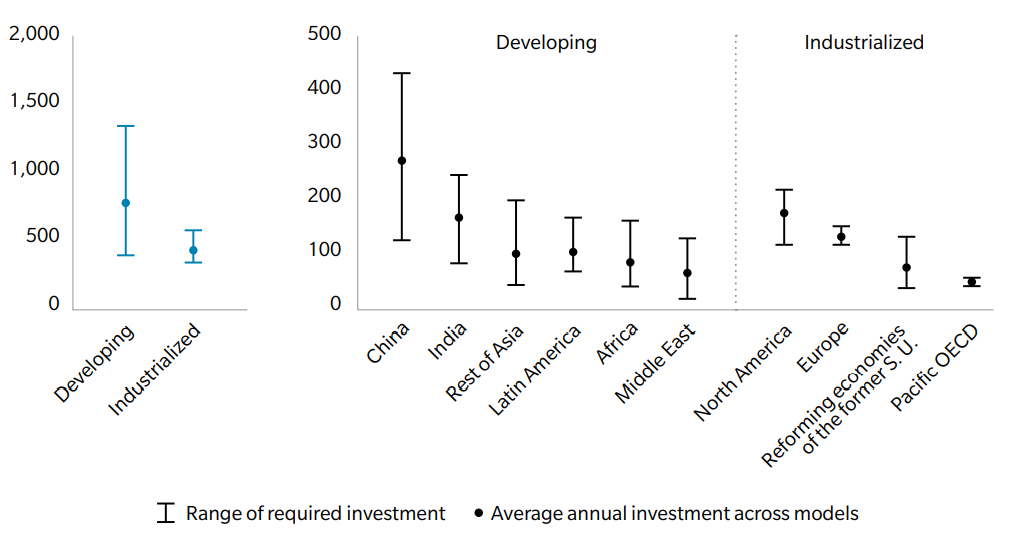

Climate Change investment opportunities:

Annual investment in renewable energy, nuclear energy, and eciency required for a 2°C scenario

USD BN/year; 2010–2050

Source: McCollum D, et al, “Energy investments under climate policy: A comparison of global models,” Climate Change Economics, Vol 4, No.4, (2013).

Coming to my next point, there are three key points which banks have to address in such cases:

- Understanding Risk: Risk arising from the environmental factors and policies established by an economy.

- Assessing Risk: Assessing one’s exposure to climate-related risk and including them in the financial contracts particularly when these risk can only be forward looking and much on anticipation e.g., by creating such scenarios and stress-testing them on the balance-sheet.

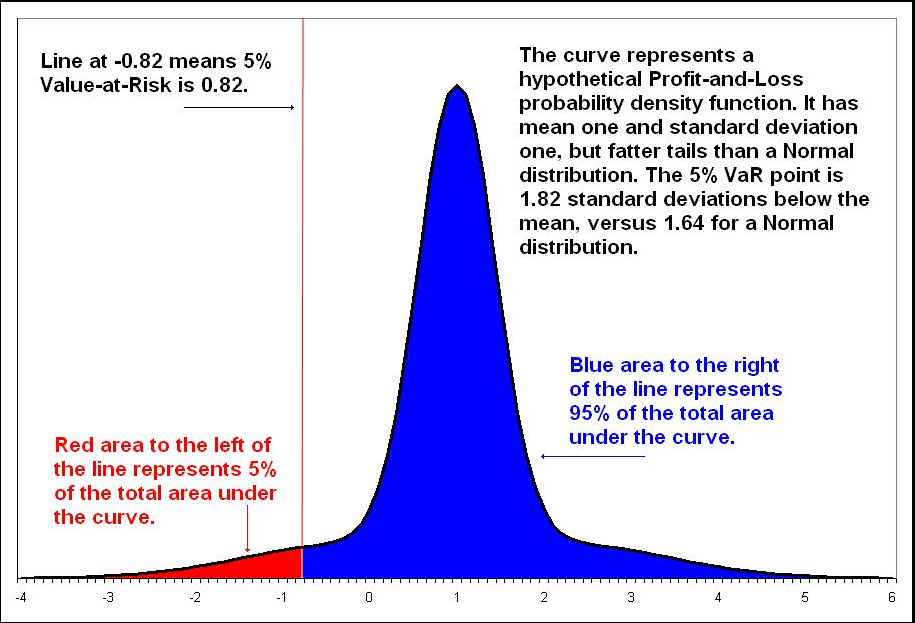

We consider risks to set capital requirements, one such way is VaR:

Value at risk (VaR) is a measure of the risk of loss for investments. It estimates how much a set of investments might lose (with a given probability), given normal market conditions, in a set time period such as a day. VaR is typically used by firms and regulators in the financial industry to gauge the amount of assets needed to cover possible losses.

Source: Wikepedia

For a given portfolio, time horizon, and probability p, the p VaR can be defined informally as the maximum possible loss during that time after excluding all worse outcomes whose combined probability is at most p. This assumes mark-to-market pricing, and no trading in the portfolio.[1]

For example, if a portfolio of stocks has a one-day 95% VaR of $1 million, that means that there is a 0.05 probability that the portfolio will fall in value by more than $1 million over a one-day period if there is no trading. Informally, a loss of $1 million or more on this portfolio is expected on 1 day out of 20 days (because of 5% probability).

They key here is after excluding all worse outcomes, but climate-related risk is a worst outcome. In presence of fat tails, one can’t assume normality and therefore, traditional VaR doesn’t work in such cases.

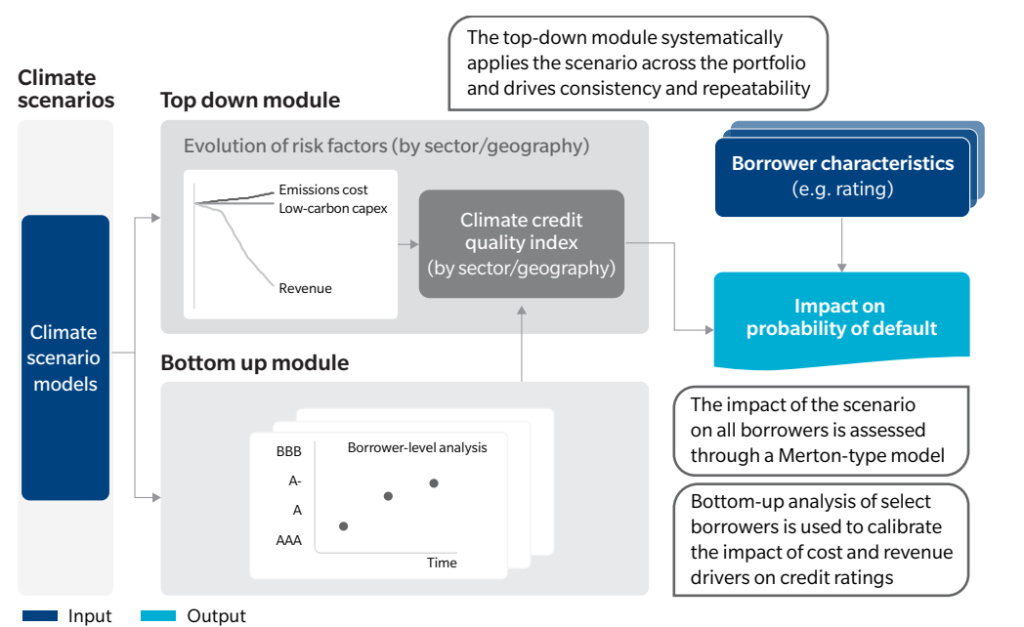

In such cases, scenario based analysis helps. The banks typically stress test using scenarios to analyze the impact on their balance sheet, scenarios such as Russia Ukraine ware, Stagnation and Inflation, etc and an additional scenario to include climated-related stress test is a viable option. Regulators are increasingly seeing the importance of the inclusion and thereby, focus on FI’s to assess specific to their balance-sheet.

Source: Oliver Wyman

- Mitigating Risk: By assessing the risk and taking measures such that massive loss can be avoided.

Then, my next question is, should we invest in the bonds of the countries who have not included or not planned to tackle climate related risk. I would say the percentage allocation to such bonds should be way less. The collective efforts of world economy and its regulations can bring long-term environmental related changes in a positive way and can bring financial stability in the market.

The power of investors:

The investors should invest in the firms considering these points as more positions are taken in the firms who are in their journey of achieving net zero carbon emission can change the market and the regulations in their economy and will encourage others to follow the same path.

The investor’s should not neglect their open positions on investments which have fossil fuels as an underlying position.

In a nutshell, countries should take measure and have regulations with focus on net zero carbon emission and avoiding infrastructure based on fossil fuels. The FIs should consider their exposure on assets/ firms which creates pollution or have exposure in carbon emission so that it is included in their financial contracts. In addition, scenario analysis and stress testing on their balance sheet is a way to do financial assessment to understand the capital requirements and ways to minimize exposure in such volatile assets.